24

Juil 2024

- Articles et presse

Corporate Sustainability Due Diligence Directive (CSDDD)

Article written by Alexander Vidler, Senior ESG Consultant and Helena Neave, ESG Consultant.

WHAT IS CSDDD?

The Corporate Sustainability Due Diligence Directive (CSDDD) fosters sustainable and responsible corporate behaviour for companies active in the EU market. The directive creates a legal liability focusing on actual and potential human rights and environmental adverse impacts with respect to companies’ own operations, their subsidiaries, and business partners in their value chains.

The due diligence duty of the directive sets rules on obligations for companies regarding human rights and environmental considerations including child labour, slavery, pollution, deforestation, excessive water consumption and damage to ecosystems.

CSDDD is the first EU legislation mandating the adoption of a climate transition plan in line with the 2050 net zero objective.

CSDDD REPORTING REQUIREMENTS

CSDDD covers the six steps defined by the OECD Due Diligence Guidance for Responsible Business Conduct:

- Integrating due diligence into policies and management systems

- Engaging with stakeholders – due diligence policy developed in consultation with company’s workers and representatives

- Identifying and assessing adverse human rights and environmental impacts

- Prioritise adverse impacts based on severity and likelihood – providing remediation to actual adverse impacts

- Preventing, ceasing or minimising actual and potential adverse impacts – assessing effectiveness of measures

- Establishing and maintaining notification and complaints procedures

Penalties

Member States must designate national supervisors to ensure and monitor enforcement and can determine penalties at Member State level. Pecuniary penalties and a public statement may be applicable.

HOW DOES CSDDD AFFECT YOU?

The directive applies to EU and non-EU companies.

| EU Companies | Non-EU Companies | Franchised companies (EU and non-EU) |

| >1,000 employees | EUR 450M turnover in EU | EUR 80M turnover |

| Global turnover of EUR 450M | EUR 22.5M in royalties |

CSDDD will be phased in, starting three years from entry into force. It is expected to target about 5,500 companies.

| 2027 | 2028 | 2029 |

| >5,000 employees | >3,000 employees | >1,000 employees |

| EUR 1,500M turnover | EUR 900M turnover | EUR 450M turnover |

| Non-EU companies EUR 1,500M turnover in EU | Non-EU companies EUR 900M turnover in EU | Non-EU companies with EUR 450M turnover in EU |

| Franchised companies |

IMPORTANT UPDATES

CSDDD was officially published into the Official Journal of the EU in July 2024 and will enter into force by the end that month. This means that EU member states will need to transpose the directive into national law by July 2026.

Impact on the financial sector

Regulated financial firms meeting CSDDD thresholds are included in the directive. However, they are limited by being responsible for their own operations and upstream supply chain due diligence only. This means that downstream value chains receiving financial services and products such as investments, loans, and insurance activities are not considered in-scope. It is important to distinguish that portfolio companies meeting CSDDD thresholds will be in-scope for the full reporting obligations.

Despite the above, financial institutions could still be affected indirectly by CSDDD’s full reporting requirements when in-scope business counterparties perform mandated due diligence on them. In these cases, financial institutions may be requested for information about their operations.

Additionally, according to the requirements set out by the directive, firms across the financial sector must adopt transition plans in line with the 2050 net zero objective. In practice, preparation of such transition plans will also likely require downstream due diligence.

There is a review clause to CSDDD and the financial sector where the EU Commission must report within two years on whether to extend due diligence obligations to include downstream operations.

HOW PÉRICLÈS GROUP CAN HELP WITH CSDDD REPORTING

Using Périclès Group’s expertise, and our knowledge gathered from previous missions, we have a strong track record of understanding and implementing various strategies to mitigate the reporting requirements.

We create a bespoke approach for each client, depending on their needs. Our tailored offering may include, but is not limited to:

Maturity Assessment

CSDDD focuses on defining and implementing due diligence into companies’ policy and management systems. Provision of a Sustainability Maturity Assessment assists firms in identifying and mitigating any possible adverse impacts linked to human rights and/or the environment, whilst identifying any gaps in the directive’s obligations.

Value Chain Compliance and Investigation

Périclès Group’s unique understanding of the relationships between corporate entities and their value chains allows us to interact with and examine supply chains of varying sizes effectively and efficiently. Understand and implement bespoke practises to investigate how value chains identify, assess, and mitigate potential adverse impacts in line with the directive.

Transitional Plans and Implementation

Périclès Group works with financial and corporate entities to assist them with creating bespoke plans to transition into a net zero form of operating. Additionally looking at individual metrics and the firms’ performance specifically linked to ESG and broader Sustainability factors.

For any questions or more details on our CSDDD offering, please don’t hesitate to contact us.

Want to find out more about Pericles Group?

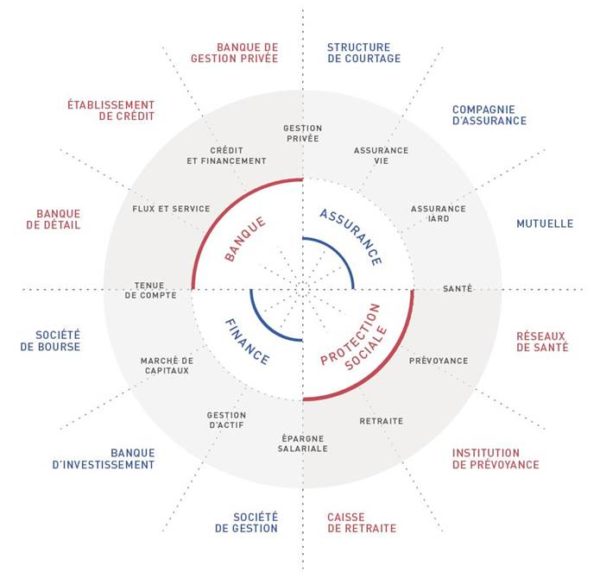

Périclès Group is an independent consulting firm in strategy, organization, actuarial, project management and operational support, specialized in the fields of Banking, Finance, Insurance and Social Protection.

Périclès Group places expertise at the heart of its know-how. The Group is present in France, Luxembourg, the United Kingdom, Switzerland, Luxembourg, and Hong Kong.

Autres actualités

22

Déc 2025

- Articles et presse

Adoption du PLFSS 2026 : décryptage des principales mesures

16

Déc 2025

- Articles et presse

Proportionnalité sous Solvabilité II : Réussir votre transition

20

Nov 2025

20

Nov 2025