At the same time, the ever-tightening regulatory framework increases their costs and operational risks. Consequently, Asset Managers seek to focus on their core activities and to entrust their other activities to service providers.

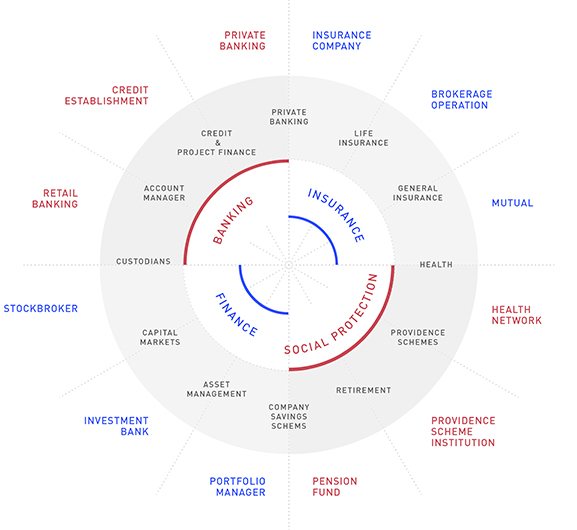

In this context, Asset Servicers present themselves as strategic partners of Asset Managers by offering them a wide range of services adapted to the management of funds or mandates. Beyond the traditional back office services (custody, depositary control and fund administration), Asset Servicers offer value-added services and go up the value chain of the management industry: negotiation table, middle office, client reporting, risk and performance attribution reporting, regulatory reporting, fund distribution solution, dissemination of product information, legal assistance with the life of the funds, etc.). We should also not forget the Fintechs and other publishers of technological solutions which now offer business outsourcing offers to Asset Managers.

The number of providers and services for Asset Management is increasing. Based on this observation, the choice of the right service provider is a major issue for asset management companies and institutional investors.

Périclès Group has significant experience in conducting tenders and selecting service providers on behalf of Asset Managers or institutional investors. Our knowledge of providers and their offers, our proven selection methodology and our total independence guarantees our customers to choose the best partner that meets their expectations.

Choose Périclès Group to find your providers.