03

Juil 2024

- Articles et presse

Sustainable Finance Disclosure Regulation (SFDR)

Article written by Alexander Vidler, Senior ESG Consultant and Helena Neave, ESG Consultant.

WHAT IS SFDR?

SFDR contributes to the EU’s objective to shift toward a net zero economy, helping investors make informed decisions on their investments by providing transparency on the degree to which financial products consider environmental and/or social characteristics.

Applicable as of March 2021, it requires financial market participants (FMPs) and financial advisers to disclose at the entity and product level how they integrate sustainability risks and principle adverse impacts (PAIs) into investment decision-making processes.

SFDR REPORTING REQUIREMENTS

Requirements for asset managers and financial advisers

An asset manager must either implement a due diligence policy concerning PAIs associated with investment decisions or explain the reasons why it does not consider such adverse impacts.

Additionally, they must update existing remuneration policies to include information on how the policy is consistent with integrating sustainability risks.

Requirements for financial products

If a due diligence policy has been implemented, an asset manager must decide whether and how each financial product considers PAIs on sustainability factors.

If it has not implemented a sustainability due diligence policy, it must explain for each financial product the reasons why it does not consider such adverse impacts.

Requirements for financial products with specific sustainability-focus

Additional disclosures are required where a financial product promotes environmental and/or social characteristics, has sustainable investments as its objective, or has a reduction in carbon emissions as its objective.

HOW DOES SFDR AFFECT YOU?

SFDR’s scope is broad, applying to all FMPs and financial advisers based in the EU, as well as investment managers or advisers based outside of the EU that market their products to clients in the EU.

Product disclosures apply to UCITS, AIFs, portfolio management services, sub-advisory mandates, and financial advice.

IMPORTANT UPDATES

Articles 6, 8, and 9 are SFDR financial product classifications to enhance transparency and accelerate sustainable investments.

SFDR does not specify thresholds for assessing sustainable investments within each classification but does provide guidelines for products. Article 9 is the exception, highlighted below:

- Article 6 – products either integrate financial material ESG risk considerations into the investment decision-making process or explain why sustainability risk is not relevant but do not meet the additional criteria of Article 8 or Article 9 products

- Article 8 – products promote social and/or environmental characteristics and may invest in sustainable investments but do not have to have sustainable investing as a core objective. These funds should have a portfolio where at least 80% of assets meet the fund’s sustainability objectives

- Article 9 – products have a sustainable investment objective. These funds must invest 100% in sustainable investments, except for neutral assets. There are calls to reduce this threshold to 80%

Currently, SFDR is not a labelling scheme. However, this could change based on the recent consultation in September 2023. The consultation revealed that Articles 8 and 9 SFDR products are being used as de-facto product labels despite SFDR not being intended for such purposes. Fund managers may be using Articles 8 and 9 in their marketing to imply a degree of sustainability. This means that the market is using SFDR as a labelling system or a way to market sustainability funds.

ESMA launched a consultation on how current guidelines for funds’ names, focusing on the sustainability keywords, are being used incorrectly for marketing purposes. The authority states that funds using such keywords should be supported with evidence of such characteristics and/or objectives.

Following the consultation, ESMA will amend the threshold for what can be labelled as sustainable. Funds should only use sustainability-related names if: 1. the fund applies 80% minimum proportion of investments that meet sustainability characteristics and/or objectives; 2. the fund applies Paris-aligned Benchmarks exclusions; and 3. if the investments fall under the definition for SFDR. Additionally, there will be an introduction of new ‘sustainable’ and ‘transition’ categories for financial products including investment funds, life insurance, and pensions products.

Updated guidelines will apply 3 months after the publication of the AIFMD and UCITS Directive review.

HOW PÉRICLÈS GROUP CAN HELP WITH SFDR REPORTING

Using Périclès Group’s expertise surrounding SFDR, and our knowledge gathered from previous missions, we have a strong track record of understanding and implementing various strategies to mitigate the reporting requirements.

We create a bespoke approach for each client, depending on their needs. Our tailored offering may include, but is not limited to:

Portfolio generation & structuring

Périclès Group has worked with products in both the public and private space, specifically creating products to achieve sustainability goals and targets aligning with investments within the products.

Portfolio optimisation

Understanding the difference between both Article 8 and Article 9 funds in their entirety allows Périclès Group to optimise portfolios efficiently to achieve internal mandates and firmwide ambitions.

Product development

Product growth and changes over time are rarely accounted for or foreseen, but investors and the broader marketplace until it is too late – Périclès Group’s constant presence and interactions with the market can help mitigate these changing scenarios.

Training & Education

Part of the changing environment and landscape is ensuring that key stakeholders and institutions at large are educated and prepared for the evolving environment and changing circumstances surrounding sustainability finance and investment.

For any questions or more details on our SFDR offering, please don’t hesitate to contact us.

Want to find out more about Pericles Group?

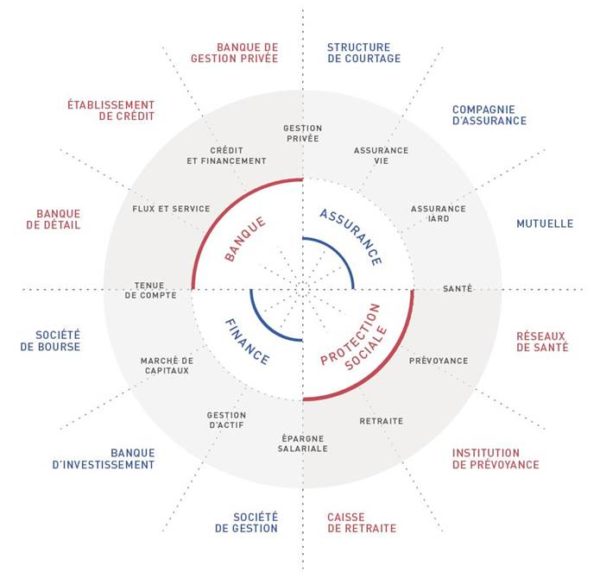

Périclès Group is an independent consulting firm in strategy, organization, actuarial, project management and operational support, specialized in the fields of Banking, Finance, Insurance and Social Protection.

Périclès Group places expertise at the heart of its know-how. The Group is present in France, Luxembourg, the United Kingdom, Switzerland, Luxembourg, and Hong Kong.

Autres actualités

08

Juil 2025

26

Juin 2025

- Articles et presse

Principes et limites du financement de la défense dans un cadre ESG

22

Mai 2025

- Articles et presse

Les enjeux du financement de la défense pour le secteur de l'assurance

29

Avr 2025