28

Mai 2024

- Articles et presse

The EU Deforestation Regulation (EUDR)

Article written by Alexander Vidler, Senior ESG Consultant and Helena Neave, ESG Consultant.

WHAT IS EUDR?

The EU is one of the world’s largest contributors to deforestation. To significantly reduce the EU’s impact on deforestation, forest degradation, climate change, and biodiversity loss, the EU has committed to developing partnerships with producing countries and working with partner countries and companies toward deforestation-free supply chains.

EUDR requires companies to trace their supply chains to prove that any imported and exported in-scope products are ‘deforestation-free’; when the product itself, ingredients, or derivatives are not produced on land subject to deforestation or forest degradation after December 31st, 2020.

The EU Commission expects EUDR to:

- Prevent EU-listed products from contributing toward deforestation and forest degradation

- Reduce carbon emissions caused by EU consumption and production of in-scope products by 32 million metric tonnes a year

- Address deforestation driven by agricultural expansion

WHAT ARE THE REGULATION’S REPORTING REQUIREMENTS?

EUDR mandates companies to conduct due diligence across seven commodities and their derived products. It applies to goods produced on or after June 2023.

- Cattle

- Cocoa

- Coffee

- Oil palm

- Rubber

- Soy

- Wood (except timber)

In-scope products must meet three conditions to be considered EUDR-compliant:

- Do not contribute to deforestation or forest degradation

- Produced within the legislation of the country of production, including environmental regulations, land-use rights, forest management, labour, human rights laws, etc.

- Covered by a thorough due diligence statement, companies must publicly report this annually, keeping relevant documentation for five years.

WHO DOES THE REGULATION IMPACT?

EUDR applies to operators and traders who buy/sell in-scope products in or from the EU:

- Operator is any natural or legal person who places in-scope products on or exports them from the EU market

- Trader any person in the supply chain, other than operators, who make in-scope products available on the market

In cases where EUDR reporting has not been met, each supply chain actor concerned with the in-scope product retains responsibility and may be held liable.

Sanctions for non-compliance can include fines of up to 4% of the company’s turnover in the EU and measures for confiscating products and income. A temporary prohibition from dealing with in-scope products in the EU or a ban from using the simplified due diligence process may occur for severe or repeated breaches.

REPORTING TIMELINE

2024: Large and medium-sized undertakings, fulfilling at least two of the three conditions, need to be compliant by December 30th.

| Large undertaking | Medium undertaking |

| EUR 20M balance sheet | EUR 20M balance sheet |

| EUR 40M net turnover | EUR 40M net turnover |

| 250 employees | 250 employees |

2025: Small and micro undertakings, fulfilling at least two of the three conditions, need to be compliant by June 30th.

| Small undertaking | Micro undertaking |

| EUR 4M balance sheet | EUR 350k balance sheet |

| EUR 8M net turnover | EUR 400k net turnover |

| 50 employees | 10 employees |

2028: The EU Commission conducts a general review of EUDR every 5 years after that.

Where can Périclès Group help?

GAP ANALYSIS

Considering a firm’s unique operating procedures, individual management strategies, development, and changing pathways – alongside internal stakeholder engagement and what a company’s ESG and broader Sustainability goals are, pins together the framework of what Périclès Group does and how we operate as an entity.

SUPPLY CHAIN COMPLIANCE & INVESTIGATION

Corporate entities operate in harmony with one another to deliver the best product for their client bases. Périclès Group’s unique understanding of these relationships allows us to interact with supply chains of varying sizes effectively and efficiently whilst examining them through a lens of understanding their unique workings, with the aim and end outcome to harmonise standards of reporting and production across all facets of ESG and, more broadly, Sustainability.

TRANSITION PLANS AND IMPLEMENTATION

Périclès Group has worked with both financial and corporate entities to assist them with creating bespoke plans for those firms to transition into a net zero form of operating and additionally looking at metrics, the firms’ performance specifically linked to ESG and broader Sustainability factors.

Facilitating a firm’s commitment to sustainability, time horizon, stakeholder and broader ambitions whilst maintaining budgeting and costing concerns is the ethos Périclès Group employs when helping firms transition and implement sustainability-linked strategies.

CORPORATE SUSTAINABILITY STRUCTURING

Assisting with the creation of sustainability structuring through the middle office or working alongside boards and key stakeholders to put efficient ESG and Sustainability structures in place allows Périclès Group to provide tailored solutions and structures specific to clients’ needs and requirements.

Want to find out more about Pericles Group?

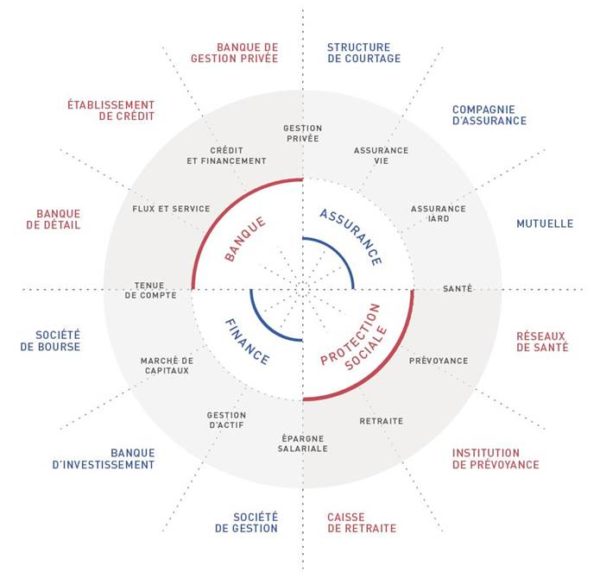

Périclès Group is an independent consulting firm in strategy, organization, actuarial, project management and operational support, specialized in the fields of Banking, Finance, Insurance and Social Protection.

Périclès Group places expertise at the heart of its know-how. The Group is present in France, Luxembourg, the United Kingdom, Switzerland, Luxembourg, and Hong Kong.

To contact us, click here.

Autres actualités

11

Fév 2025

28

Jan 2025

- Articles et presse

- Événements

Baromètre de la distribution de fonds

07

Jan 2025

19

Déc 2024